中文版English

Home > Products > Copper(BC)

Copper(BC) Futures Contract

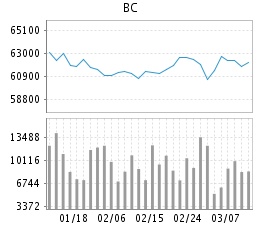

BC Price Chart

-

Contract InformationTrading Day:2023-03-08Update:2023-03-08 16:01:10[more]

Code Listing Date Expiration Date First Delivery Day Last Delivery Day Benchmark Price bc2303 20220316 20230315 20230316 20230322 63520 bc2304 20220418 20230417 20230418 20230424 63520 bc2305 20220517 20230515 20230516 20230522 63520 bc2306 20220616 20230615 20230616 20230626 63520 bc2307 20220718 20230717 20230718 20230724 51960 bc2308 20220816 20230815 20230816 20230822 52930 bc2309 20220916 20230915 20230918 20230922 54190 bc2310 20221018 20231016 20231017 20231023 52970 bc2311 20221116 20231115 20231116 20231122 57380 bc2312 20221216 20231215 20231218 20231222 57480 bc2401 20230117 20240115 20240116 20240122 57390 bc2402 20230216 20240215 20240216 20240222 58720 -

Trading Parameter Trading Day:2023-03-08Update:2023-03-08 16:01:20[more]

Code Margin Rate Limit Up(%) Limit Down(%) Long Speculation(%) Short Speculation(%) Long Hedging(%) Short Hedging(%) bc2303 15 15 15 15 10 10 bc2304 12 12 12 12 10 10 bc2305 12 12 12 12 10 10 bc2306 12 12 12 12 10 10 bc2307 12 12 12 12 10 10 bc2308 12 12 12 12 10 10 bc2309 12 12 12 12 10 10 bc2310 12 12 12 12 20 20 bc2311 12 12 12 12 20 20 bc2312 12 12 12 12 10 10 bc2401 12 12 12 12 20 20 bc2402 12 12 12 12 20 20 -

Settlement Parameter Trading Day:2023-03-08Update:2023-03-08 16:01:40[more]

Note:

1.The transaction fee for closing out the position opened on the same day=the haircut rate for closing out the position opened on the same day * transaction fee, which is waived then the value is zero.

2.Transaction fee for copper(bc) futures shall refer to the rate of transaction fee.Code Settle Fee Percentage

(‰)Trans

Fee(RMB

/lot)Delivery

Fee(RMB

/ton)Margin Rate Discount Rate for Closing-out Today’s Position (%) Long

Speculation

(%)Short

Speculation

(%)Long

Hedging

(%)Short

Hedging

(%)bc2303 61340 0.010 0 0 15 15 15 15 0 bc2304 61220 0.010 0 0 12 12 12 12 0 bc2305 61420 0.010 0 0 12 12 12 12 0 bc2306 61430 0.010 0 0 12 12 12 12 0 bc2307 61410 0.010 0 0 12 12 12 12 0 bc2308 61270 0.010 0 0 12 12 12 12 0 bc2309 60910 0.010 0 0 12 12 12 12 0 bc2310 60630 0.010 0 0 12 12 12 12 0 bc2311 60360 0.010 0 0 12 12 12 12 0 bc2312 59290 0.010 0 0 12 12 12 12 0 bc2401 59880 0.010 0 0 12 12 12 12 0 bc2402 59820 0.010 0 0 12 12 12 12 0 -

Delivery Parameter Trading Day:2023-03-08Update:2023-03-08 16:02:30[more]

Code Delivery and Settlement Price Delivery Margin Rate

(%)Physical Delivery Unit Price(RMB/ton) First Delivery Day Last Delivery Day Tax-paid Bonded bc2303 20 0 20230316 20230322 bc2304 20 0 20230418 20230424 bc2305 20 0 20230516 20230522 bc2306 20 0 20230616 20230626 bc2307 20 0 20230718 20230724 bc2308 20 0 20230816 20230822 bc2309 20 0 20230918 20230922 bc2310 20 0 20231017 20231023 bc2311 20 0 20231116 20231122 bc2312 20 0 20231218 20231222 bc2401 20 0 20240116 20240122 bc2402 20 0 20240216 20240222 -

Monthly Information Update:

Code Trading Month Trading Day Trading Margin Rate

(%)Fee Percentage

(‰)Unit Price of Trans.Fee

(RMB/Contract)

Market Data and

Charts are delayed

at least 30 minutes.

Charts are delayed

at least 30 minutes.

| Contract | Last | Chg | Open Interest | Volume | Bid-Ask | Pre-clear | Open | Comment |

| Contract | Weighted Average Price 9:00-10:15 |

Change over Previous Trading Day | Weighted Average Price 9:00-15:00 |

Change over Previous Trading Day |

Notes:

2. Contract Size: 5 tons/lot.

3.Monthly average settlement price for a calendar month contract = ∑ Daily settlement price/Number of days traded in the current calendar month

Change = Monthly average settlement price for the current day − Monthly average settlement price for the preceding trading day

4."sc active" refers to the monthly average settlement price of the active contracts.

5.sc active = ∑[A+B]/Number of days traded in the current calendar month

A = Daily settlement price of the nearest month contract (for the period from the first trading day to the

thirteenth-to-last trading day of the nearest month contract in the current month)

B = Daily settlement price of the next-nearest month contract(for the period from the twelfth-to-last trading

day of the nearest month contract to the last trading day of the next-nearest month contract in the current

month)

6.The nearest month contract and the next-nearest month contract(i.e.,the contract subsequent to the nearest

month contract) are determined on the first trading day of the current month.

7.The prices are rounded to one decimal place.

8. If the last trading day of the contract is adjusted, the monthly average settlement price will be calculated

according to the adjusted last trading day.

2. Contract Size: 5 tons/lot.

3.Monthly average settlement price for a calendar month contract = ∑ Daily settlement price/Number of days traded in the current calendar month

Change = Monthly average settlement price for the current day − Monthly average settlement price for the preceding trading day

4."sc active" refers to the monthly average settlement price of the active contracts.

5.sc active = ∑[A+B]/Number of days traded in the current calendar month

A = Daily settlement price of the nearest month contract (for the period from the first trading day to the

thirteenth-to-last trading day of the nearest month contract in the current month)

B = Daily settlement price of the next-nearest month contract(for the period from the twelfth-to-last trading

day of the nearest month contract to the last trading day of the next-nearest month contract in the current

month)

6.The nearest month contract and the next-nearest month contract(i.e.,the contract subsequent to the nearest

month contract) are determined on the first trading day of the current month.

7.The prices are rounded to one decimal place.

8. If the last trading day of the contract is adjusted, the monthly average settlement price will be calculated

according to the adjusted last trading day.

| Contract | Start Date | End Date | Mean of Settlement Price | Change |